30/12/2024

Changes to company size thresholds

The government intends for companies to be able to benefit from these changes for financial years starting on or after 6 April 2025.

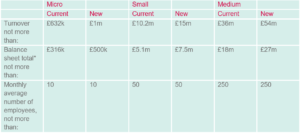

- Micro entity thresholds will increase from not more than £632,000 turnover to not more than £1 million.

- Small company thresholds will increase from not more than £10.2 million turnover to not more than £15 million.

- The upper medium company threshold will move to not more than £54 million turnover. Anything above £54 million will classify as a large company.

- The balance sheet total thresholds will also increase, to not more than £500,000 for micro-entities, £7.5 million for small companies, and £27 million for medium companies. Anything above £27 million will be considered a large company.

The table below sets out the new size thresholds that will be met for a financial year if any two of the three criteria are met.

*ie, total assets

In summary, the UK is raising its company size thresholds to reduce the regulatory burden on businesses, particularly smaller and medium-sized enterprises. These changes are expected to come into effect for financial years starting from 6 April 2025 onwards.

If you would like more information on our Business Tax Services /services/specialist-tax-and-financial-planning/or have any queries please contact Gary Brown on 023 8046 1240 or email Gary Brown.