19/06/2023

Spring Budget 2023

On 15 March the Chancellor Jeremy Hunt made his first Budget Speech, the first full Budget for 18 months. Included within the measures announced are several with implications for the charity sector:

Non-UK charities

UK tax reliefs for non-UK charities and their donors has been withdrawn with immediate effect, although transitional provisions are being implemented for those overseas charities that qualified for relief on Budget Day that will enable them to claim relief until April 2024 to give them time to make appropriate adjustments. The change also applies for non-UK Community Amateur Sports Clubs (CASCs).

This has implications for any charities or CASCs based in the EU or EAA that have taken advantage of the wide range of tax reliefs available to the charity sector, or were planning on doing so. There will also be implications for any higher rate taxpayers who donate to overseas charities as they will no longer be able to claim higher rate tax relief on those donations using gift aid.

Additional funding

One of the highlights of the Budget Speech was the announcement of extending the provision of free childcare. To help achieve this increased direct funding to nurseries from this September was announced.

Extra funding for charities and community organisations was also announced, with £100 million being targeted at those most at risk due to increased demand from vulnerable groups and higher delivery costs, as well as providing investment in measures to improve energy efficiency.

A further £63 million of support was also announced for public leisure centres and swimming pools.

Cultural tax reliefs

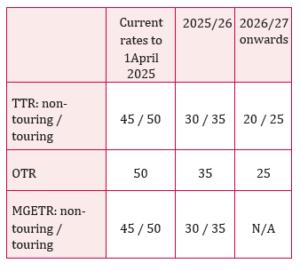

The higher rates of relief available for Theatre Tax Relief (TTR), Orchestra Tax Relief (OTR) and Museums & Galleries Exhibition Tax Relief (MGETR) are being extended for two additional years. The current higher rates will now remain in place until 1 April 2025 before being reduced for a year. TTR and OTR will then return to their normal levels from 1 April 2026, but no expenditure incurred after 31 March 2026 will be eligible for MGETR. The rates can be summarised as follows:

Homes for Ukraine

It has been confirmed that ‘thank you’ payments made by Local Authorities to individuals, business and charities under the Homes for Ukraine scheme are exempt from Income Tax or Corporation Tax, with retrospective effect from when the scheme was introduced on 14 March 2022. There are also reliefs available from the Annual Tax on Enveloped Dwellings and the 15% rate of Stamp Duty Land Tax for any dwelling made available under the scheme.

Social Investment Tax Relief

It has been confirmed that Social Investment Tax Relief will not be renewed, and will close for any new investments made from 6 April 2023.

Employment measures

The Budget contained a series of measures designed to improve the labour market and support those seeking to enter work, increase their working hours or extend their working lives. Reforms to childcare, pensions and the payment of Universal Credit grabbed most of the headlines, but there were also measures designed to improve access to employment for disabled people and those with long-term health conditions, and also for older workers.

Many charities employ staff, and will be affected by any changes to payroll taxes. With the thresholds for Income Tax* and National Insurance frozen until 2028 this will effectively increase the tax burden on both employers and individuals. The rate at which Tax and National Insurance is payable remains unchanged, with the Health and Social Care Levy that was due to be introduced from April 2023 already scrapped.

The following rates of the hourly National Living

Wage and National Minimum Wage apply from 1 April 2023:

- £10.42 for those aged 23 and over

- £10.18 for those aged 21-22

- £7.49 for those aged 18-20

- £5.28 for those aged 16-17

- £5.28 for apprentices under 19 and those aged 19 and over in their first year of apprenticeship

* A separate regime applies to income tax rates in Scotland.

Trading activities

It has been confirmed that the planned increase in the rate of corporation tax to 25% from 1 April 2023 will take place. Those with lower levels of profit are likely to see little change though, as the higher rate of tax will only apply to companies with taxable profits in excess of £250,000. The current rate of 19% will continue to apply for those companies with profit below £50,000, with the increase tapered for those with profits between those two limits.

With the tax rate increasing this could be an opportune moment for any charities that undertake trading activities to ensure that they are properly structured to avoid any unnecessary exposure to tax, possibly through the use of a separate subsidiary undertaking to carry out any trading activity.

Gov.uk: Spring Budget 2023